Loan Classifications and Provisioning

(Based on BRPD Circulars)

Types of

classification:

2.Special Mention Account (SMA)

03. Substandard(SS)

04.Doubtful(DF)

05.Bad/Loss

Classification

Criteria:

For

Cottage, Micro and Small:

In months

|

Types of Loan |

SMA |

SS |

DF |

BL |

|

Demand & Continuous Loan |

2 |

6 |

18 |

30 |

|

Term Loan |

8 |

12 |

24 |

36 |

For all other loans and

advances except Cottage, Micro and Small:

In months

|

Types

of Loan |

SMA |

SS |

DF |

BL |

|

Demand

& Continuous Loan |

2 |

3 |

9 |

12 |

|

Term

Loan |

8 |

9 |

15 |

18 |

Provisioning

|

CL Status |

ST Agri Credit |

Consumer financing other than HF LP |

HF Under Consumer Finance |

Loan to Professionals/Credit Card/

Loan to BH/MB/SD |

Cottage/ Micro/ Small |

Medium |

All other credit |

|

STD |

1% |

2% |

1% |

2% |

0.25% |

0.25% |

1% |

|

SMA |

- |

2% |

1% |

2% |

0.25% |

0.25% |

1% |

|

SS |

5% |

20% |

20% |

20% |

5% |

20% |

20% |

|

DF |

5% |

50% |

50% |

50% |

20% |

50% |

50% |

|

BL |

100% |

100% |

100% |

100% |

100% |

100% |

100% |

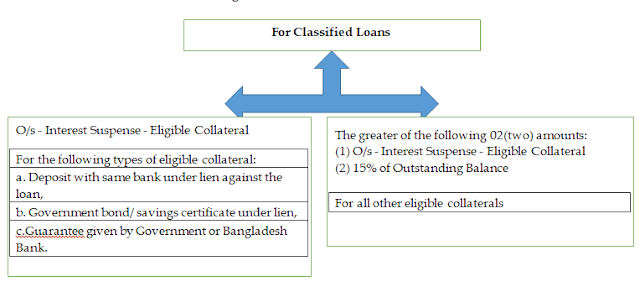

Base for

Provision

For Unclassified

Loans: Outstanding Balance

Restriction on Extending

the Term to Maturity of a Unclassified Term Loan:

The term to maturity of a

term loan may be extended subject to the following conditions and restrictions:

a) The loan must be

performing (Unclassified: Standard or SMA)

b) The decision should be made at the level where the loan was originally

sanctioned

c) The maturity date may be extended by a period of time not exceeding 25% of

the

current remaining time to maturity

Comments

Post a Comment